Studies show that about 71% of Kenyans with a mobile phone have borrowed from a loan app at least once over the past six months. As worrying as such a statistic is, it doesn’t stop 88% of them from considering taking another loan, and this has provoked the emergence of the Hikash loan app and many other digital lenders.

Let’s focus on Hikash for today. The digital lender offers mobile loans of about Ksh 2,000 – Ksh 30,000 to qualified applicants at 18.5% if you factor in the interest and all other fees. That’s a lot if you ask me, and it’s not the only alarming factor.

There’s also the 7-to-14-day repayment period, which you’ve to beat, less you start incurring a 2% daily penalty. The question, however, is, is this loan app worth it?

To answer that, I’ll explain the pros and cons of borrowing from Hikash, among other worthy notes that also reflect other loan apps in Kenya.

Here’s what I’ll cover about Hikash:

- What’s Hikash?

- What are the requirements for applying for a loan from Hikash?

- How does one apply for a Hikash loan?

- How do you repay a Hikash loan?

- What are Hikash’s pros and cons?

- Is a Hikash loan worth it?

- If not Hikash, then what?

Here we Go!

In a hurry? Here’s an overview of the Hikash mobile loan app.

Hikash Loan App Overview

| Loan Limit | Ksh 2,000 – Ksh 30,000 |

| Payment Period | 7 – 14 days |

| Loan Fees | 18.5% of the loan amount |

| Late Fees | 2% daily |

| Disbursement Route | M-PESA |

| Repayment Route | M-PESA |

| App Download | On the company website |

Who is Hikash?

Hikash is a mobile loan app in Kenya that promises instant loans to qualified applicants straight into their MPESA wallet.

Sadly, there’s scant information on the lender’s website about who they are. For example, I couldn’t find information concerning the ownership other than just the customer care contact, which also doubles up as the WhatsApp number and a Facebook link. That’s it!

What Are the Requirements for Getting a Hikash Loan?

Hikash expects you to meet these minimum requirements before you can apply for a loan from them:

- Be at least 20 years

- Possess a National ID

- Be a registered M-PESA customer

- Have access to an Android smartphone

- Be in good CRB standing

How Can I Apply For Hikash Loan?

Once you meet the above eligibility requirements, apply for a mobile loan from Hikash, and it involves these three steps:

Step 1 – Hikash App Download

Head to the lender’s website (hikash.com) and tap on the ‘Download’ tab to download the mobile app on your Android device. Sadly, this app is only available on the lender’s website, not Google Play or App Store.

Step 2 – App Installation

Once the app finishes downloading, tap on ‘Install’ to install Hikash loan app.

Step 3 – Account Registration

Now that Hikash is installed on your Android device, launch it and grant it access to your photos, media, and other files. Then, sign up with your personal information and agree to the loan app terms and conditions.

Step 4 – Loan Application

After successfully registering for an account, go ahead and log in and fill out any other information you might have left out. Look for the ‘Apply Now’ tab and click on it.

Then, choose the amount you qualify for and view the repayment period and total amount. Remember, as the lender deducts the fees, you’ll receive less than the total repayment amount (the original amount you qualified for).

Here’s an example:

Suppose you qualify for a Ksh 2,000 loan;

The lender will keep 18.5% of it (Ksh 370), which means you’ll only receive Ksh 1630. You’ll, however, need to pay back Ksh 2,000 before the deadline. Once the deadline expires, your loan will incur a 2% penalty (equivalent to Ksh 20) daily.

How Do I Repay a Hikash Loan?

You can repay a Hikash loan via M-PESA using these steps:

- Go to M-PESA then Lipa Na M-PESA

- Select pay bill and enter the Hi Kash Paybill number 181169 under Business Number.

- Enter your mobile number as the account number and input the amount borrowed.

- Enter the M-PESA PIN and send

Pros And Cons Of The Hikash Loan App In Kenya

The Pros

The Hikash loan app comes with a few advantages worth noting, and they include:

- Decent loan limits – Hikash offers loans from Ksh 2,000 to a maximum of Ksh 30,000, which is pretty decent for someone with a small financial emergency.

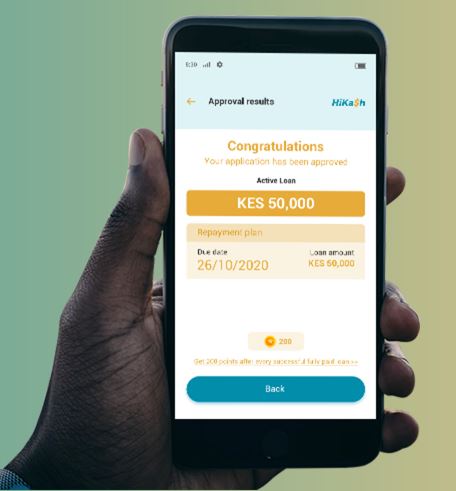

- Fast approval – It doesn’t take more than a day for Hikash to approve a loan request. Thus, you can have the money more quickly than most.

- No proof of employment requirement – Hikash doesn’t ask you for evidence of formal employment like some lenders. That makes the signup process seamless.

- Convenience – Since Hikash disburses the loan to your M-PESA wallet, you can conveniently use the funds to settle any pending M-PESA bill that the loan amount can cover.

The Cons

Despite the above pros, Hikash suffers several concerns that are worth noting. They are as follows:

- High fees – Let’s face it, 18.5% is not cheap. That’s a lot, considering a lender like the Hustler’s Fund only charges 8-9.5% annually. So, Hikash loans are pretty expensive to pay.

- Unreasonable short repayment period – Given that Hikash only offers you 7 – 14 days to repay its loans, that is not enough time for most people. At one point, you may fail to beat the deadline, and the repercussions are more serious.

- Expensive penalties – Hikash imposes a 2% of the loan amount penalty every day you fail to beat the deadline. Remember, this amount grows each day you don’t pay up, in addition to the existing loan amount.

- Debt trap – Hikash, like other loan apps in Kenya, promises to raise your limit when you are prompt with your payment. The danger is that you continue borrowing and find it difficult to get out of debt.

- Unnecessary borrowing – With mobile loan apps like Hikash comes the temptation of borrowing even when it’s not a financial emergency. We’ve heard of cases of people borrowing to gamble or buy airtime, among other unnecessary expenses. You could fall victim to that.

More Cons

- Limited transparency – As I mentioned, there’s little information about Hikash on the lender’s website. While they claim the loan processing is fast, they don’t explain much about the terms, and sometimes, what they say isn’t what you get.

- Privacy concerns – Hikash asks permission to access your phone’s media files, SMS, location, and contacts. If you ask, that is prying into your privacy, and you wouldn’t want that. Remember, they use this information to blackmail you when you default to pay.

- Blacklisting risks – Hikash, like any other lender, won’t allow you to go unpunished when you fail to pay your loan. They’ll resort to forwarding your details to the Credit Reference Bureau (CRB) for blacklisting. The danger is that it stains your credit record, making it harder to secure another loan or a public service job.

Are Hikash Loans Worth It?

After weighing Hikash pros and cons, we conclude that its loans aren’t worth it. It’s not worth paying 18.5% in fees and a 2% penalty when you fail to beat the deadline. It’s also not worth risking CRB blacklisting for a small loan amount such as Ksh 2,000.

How about the risk of continually borrowing to get a higher limit? That’s also not worth it, as it puts you in a debt trap and makes the whole borrowing thing addictive.

Indeed, there must be a better way to avoid such loan traps and still take care of your financial emergency. Let’s see what you can do next.

If Not Hikash, Then What?

We all agree that the risk of borrowing from Hikash outmuscles the advantages that the lender promises. So, what do you do to avoid borrowing during a financial emergency?

Here’s what you can do:

1. Create an Emergency Fund

An emergency fund is your immediate financial safety net when an unforeseen financial need like a medical bill, unplanned travel, a car breakdown, home repair, or job loss happens.

In that case, you wouldn’t have to borrow to meet such an expense as your emergency fund will cover everything. Here’s a guide to building an emergency fund.

2. Start Budgeting

We sometimes get into borrowing because we fail to budget for the money we make at the end of the month. So, you are only left with the option of borrowing from Hikash and other lenders.

How about you start budgeting? Remember to include how much to save in your emergency fund until it’s fully funded. It does work!

3. Shop with A List

It’s easy to say in your mind that you’ll get what you need, but if you don’t write it down, you may go outside your budget. So, it’s better to create a list that agrees with your budget and stick to it when shopping.

It’ll help you prioritize the most critical expenses and have some money to save up.

4. Find Another Income Source

If what you are making is not enough, you’ll have a problem budgeting and even funding your emergency fund. In such a case, you should consider creating another income stream.

You could get a second job, try a part-time gig, or even start a side hustle like a small business. You can even work as an online freelancer, pursuing freelance writing, online proofreading, virtual assistance, graphic design, online transcription, web design, or any other you qualify for.

In Conclusion

The Hikash loan app, like every other mobile lender, is a debt trap, and there’s no other way to call it. They are there to drain you financially, charging high fees and hefty penalties to offer you a quick emergency loan.

So, we don’t advocate for it as Cent Warriors. Instead, we campaign for an emergency fund, budgeting, shopping with a list, and finding a second income source.

We also share several other tips you can use to stray away from debt and build a financially fruitful life. Check out fantastic resources on our online store to start planning your way out of the monster called debt.