Whether it’s paying for electricity, goods at the supermarket, or just any other ‘Lipa Na MPESA’ transaction, it’s now possible to do it from MPESA to DTB Bank. All that’s needed to effect the transfer is a DTB Paybill number.

Diamond Trust Bank allows you to send money from your MPESA using the Paybill number 516600. It’s quick, safe for both parties, and, most importantly, convenient as you pay using your mobile phone.

Remember, that also means you can deposit money from your MPESA wallet to your DTB account. You don’t have to withdraw the funds from an MPESA agent and queue at a DTB branch to deposit them. You don’t even have to incur unnecessary charges.

Not only that, but you can also do the reverse. DTB allows you to withdraw money from your Diamond Trust Bank account and put it into your MPESA wallet, which is quite convenient. I’ll explain how to do both and the charges you will likely incur.

Moreover, I’ll explain another DTB Paybill option to load money into your DTB credit card using MPESA.

Here’s what we shall focus on:

- How do you send money from MPESA to DTB using the Paybill number?

- How do you load your DTB credit card using the MPESA Paybill number?

- How do you transfer money from DTB to MPESA?

- What are the charges for MPESA to DTB transactions?

- How does the DTB Till Moja work?

- What are the various DTB digital payment channels?

- How do you contact DTB in Kenya?

Let’s dive in!

How to Send Money from MPESA to DTB Account Using Paybill Number

You can easily send or deposit money to a DTB account via MPESA using Paybill Number 516600. That allows you to quickly transfer money from your MPESA wallet into your DTB savings account or to just a Lipa Na MPESA transaction into a DTB Bank.

Generally, here’s how to deposit money from MPESA to DTB account:

- Go to MPESA on your mobile phone or launch the MPESA app if you’ve it

- Choose ‘Lipa Na MPESA’ and then ‘Paybill

- Tap on ‘Business Number’ and enter the DTB Kenya Paybill number 516600

- Enter the DTB account number you want to deposit the money

- Input MPESA PIN, confirm the details, and tap ‘Send’

- Wait for confirmation SMS from DTB and MPESA

How to Load Your DTB Credit Card Using Paybill Number

When loading your DTB credit card with money from MPESA, you don’t use the Paybill Number 516600. Instead, you use the Paybill Number 584429, and here’s how to go ahead with the process:

- Go to MPESA on your mobile phone or open the MPESA app

- Choose ‘Lipa Na MPESA’ and then ‘Paybill

- Tap on ‘Business Number’ and enter 584429

- Under account number, enter your registered mobile number plus the last four digits on your DTB credit card

- Input MPESA PIN, confirm the details, and tap ‘Send’

- Wait for confirmation SMS from DTB and MPESA

How to Transfer Money from DTB Account to MPESA

You don’t need a Paybill number to withdraw money from your DTB account; you can put it into your MPESA wallet. Instead, you need the DTB USSD code *382#. That means you can do it without the internet and, more importantly, even without a smartphone. However, before using this service, you must sign up for internet or mobile banking.

Here’s how to withdraw money from DTB Bank to MPESA:

- Dial *382# on your mobile phone

- Select ‘More Money,’ then MPESA

- Choose ‘MPESA Recipients’

- Enter the amount to transfer

- Choose the DTB account to withdraw from

- Confirm the transaction details

- Input your DTB mobile banking PIN

- Wait for confirmation

DTB MPESA Paybill Charges

Ordinarily, you incur similar charges to other Paybill transactions when transferring money from MPESA to DTB. Here’s a tabulation of the MPESA to DTB account transfer charges as of 1st January 2023:

| Amount (Ksh) | Charge (Ksh) |

| 1 – 100 | Free |

| 101 – 500 | 11 |

| 501 – 1,000 | 15 |

| 1,001 – 1,500 | 18 |

| 1,501 – 2,500 | 25 |

| 2,501 – 3,500 | 35 |

| 3,501 – 5,000 | 47 |

| 5,001 – 7,500 | 57 |

| 7,501 – 20,000 | 67 |

| 20,001 – 250,000 | 70 |

DTB Till Moja – How it Works

The DTB Till Moja is a payment option by Diamond Trust Bank that allows its merchants to accept payments from different mobile money avenues, especially Airtel Money, MPESA, and T-Kash. As a DTB merchant, you receive a 6-digit code that your customers can use to pay you.

The advantages are that merchants do not incur signup charges, and you get instant payment alerts. Even better, there’s no limit to the amount you can receive as a merchant. You can sign up for multiple till numbers depending on the number of businesses you run.

In the long run, the DTB Till Moja payment option helps to rebuild or improve your credit record, making it easy to secure a loan from DTB.

To apply for this till number, you should:

- Go to the DTB Kenya website

- Tap on the main menu and select ‘Product and Services’

- Tap on ‘Services’ and choose ‘Till Moja Payment Solution’

- Locate the ‘Till Moja Payment’ application form at the bottom of the page and download it

- Fill out the application form and send it back to DTB via email

- Wait for DTB to process your 6-digit Till Moja code

Note also that the DTB Till Moja is not just beneficial to the DTB bank account holder merchant. It’s also advantageous to the customer as they don’t have to worry about how they’ll pay. All they have to confirm is that they have money in their mobile wallet and that they bring their phone with them. That’s it!

Various DTB Digital Channels

Diamond Trust Bank is one of the leading advocates of digital payment solutions across Kenya and beyond. Currently, DTB employs several digital payment solutions, and here are the three most popular channels:

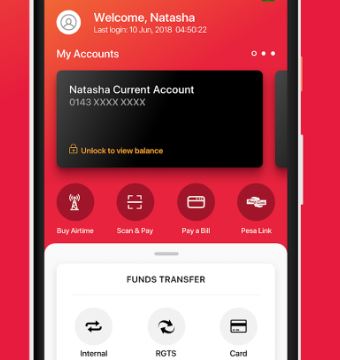

1. DTB Mobile Banking

DTB mobile banking allows you to transact using your mobile phone on the go as you get real-time notifications. You can do it using the DTB USSD code *382#, which I talked about earlier, or the DTB m24/7 app, which you can download from Google Play or Apple Store.

If you opt for the app, you can secure your account with Face ID or fingerprint authentication, making it safer. Moreover, the app allows you to request a checkbook, scan supermarket payment codes, and even buy airtime.

Here are the respective charges that apply to DTB mobile banking:

| Transaction | Charge (Ksh) |

| Balance inquiry | Free |

| Forex viewing | Free |

| Airtime top-up | Free |

| Mini-statement requests | Free |

| Internal fund transfer | Ksh 30 |

| Bill payments | Ksh 30 |

| Cheque status | Ksh 15 |

2. DTB Internet Banking

Through DTB Internet banking, you can transact on the go using any Internet-enabled device. The digital channel allows you the same conveniences as DTB mobile banking, and here are the applicable charges:

| Transaction | Charge (Ksh) |

| Balance inquiry | Free |

| Account statements | Free |

| Email alerts | Free |

| User testing | Free |

| Internal funds transfer | Ksh 30 |

| ETF | Ksh 100 |

| RTGS | Ksh 500 |

| SWIFT | Ksh 1,500 |

Overall, you can download the DTB internet banking application form from their website and fill it out before you can start using the service.

3. DTB Automated Teller Machine

Like most banks, DTB allows you to dispense cash, view your balance, and deposit money at a DTB automated teller machine. You can also do it at a Kenswitch-branded ATM.

The advantage of this channel is that it allows you to transact beyond the usual banking hours. Moreover, you can view your mini-statements just in case you want to keep tabs on your spending.

DTB Global Money Transfer

DTB has partnered with World Remit, Western Union, and MoneyGram to allow you to send and receive money globally. You can do this by visiting the nearest DTB branch or using the DTB m24/7 app.

The Charges:

Western Union

For Western Union transfers, you’ll incur 1% of the principal amount

MoneyGram

Here are the charges:

| Amount (Ksh) | Transfer Charge (Ksh) |

| Up to 8,000 | 95 |

| 8,001 – 16,000 | 180 |

| 16,001 – 24,000 | 350 |

| 24,001 – 48,000 | 550 |

| 48,001 – 160,000 | 600 |

DTB and Pesalink

Now, you can transfer money from DTB to other banks in real time using Pesalink. It’s quick and convenient, especially if you are a DTB mobile banking customer. Here are the transfer charges incurred:

| Amount (Ksh) | Charge (Ksh) |

| Up to 500 | Free |

| 501 – 5,000 | 70 |

| 5,001 – 10,000 | 85 |

| 10,001 – 100,000 | 110 |

| 100,001 – 999,999 | 130 |

DTB Kenya Contacts

You can contact DTB Kenya using any of these routes:

- Head Office: DTB Centre, Mombasa Road, Nairobi, Kenya

- Telephone: (020) 284 9000

- Mobile: +254 719 031 888 or +254 732 121 888

- Email: contactcentre@DTBafrica.com

- Facebook: @DTBDuo

- Instagram: @DTBDuo

Concluding Thought:

Generally, you can use the DTB Paybill number 516600 to transfer money from MPESA to DTB Bank. That includes paying for goods and services with MPESA and transferring money from your MPESA wallet to your DTB account.

But other than that, you can load money into your DTB credit card using the MPESA pay bill number 584429. The two pay bill numbers are pretty different, so knowing when to use each of them is essential. You can use the above guide.

If you have questions or concerns, you can contact DTB customer support using the contact details shared.

Also Read: