Life is uncertain.

But your children’s future doesn’t have to be.

Let me explain Whole Life Insurance in the simplest way possible—using Mike’s story.

Meet Mike

Mike is 37 years old.

A husband.

A father of two.

He made one decision that guaranteed his wife and children’s future—whether he’s alive or gone.

Mike’s biggest fear isn’t dying.

His biggest fear is leaving his children exposed—at the mercy of the world.

Financially distressed.

His wife struggling alone.

- No school fees

- No rent

- No food

- No medical cover

- Dreams left unfinished

That fear pushed him to act.

That’s why Mike set up a Whole Life Insurance Policy.

What Whole Life Insurance Really Is

Whole Life Insurance is income protection and legacy creation in one plan.

It does three powerful things:

- Protects your family if you pass on

- Protects you while you’re alive (Living Benefits)

- Guarantees an inheritance for your children

This is not speculation.

This is certainty.

How Mike’s Policy Works

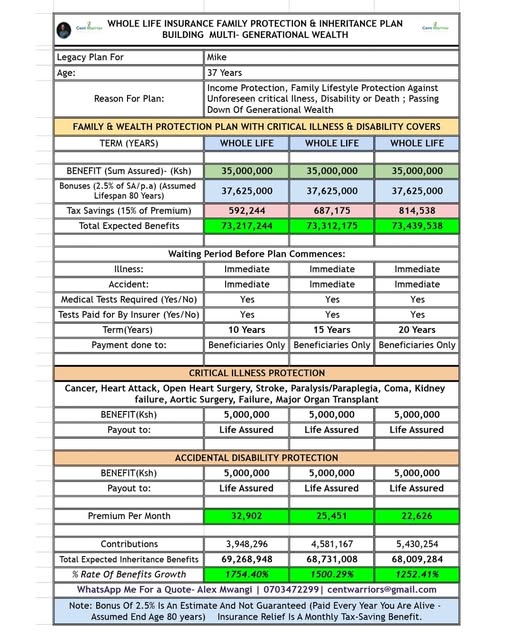

Mike structured his policy as follows:

- Sum Assured (Death Benefit): Ksh 35,000,000

- Critical Illness Cover: Ksh 5,000,000

- Accidental Disability Cover: Ksh 5,000,000

- Premium Payment Period: 15 years

- Monthly Premium: Ksh 25,451

- Projected Bonuses (Age Up to 80 Years): Ksh 37,625,000

- Total Tax Relief: Ksh 687,175

If Mike dies at any point—tomorrow or at 80—Ksh 35 million plus all accrued bonuses is paid to his children.

Guaranteed.

Protected.

That is inheritance by design, not by chance.

Living Benefits (This Is the Part Most People Miss)

Whole Life Insurance is not only about death.

If Mike suffers from:

- Cancer

- Stroke

- Heart attack

- Paralysis

- Coma

- Permanent disability

The policy pays him a lump sum while he is alive.

Why?

Because illness destroys income and investments faster than death.

This money:

- Pays medical bills

- Replaces lost income

- Keeps his children in school

- Protects the family’s dignity

Insurance is not a cost.

It is guaranteed financial protection.

Why This Matters for Mike’s Family

This policy ensures:

- Unsecured debts are cleared

- Daily living expenses are covered

- School fees are paid—from daycare to university

- Funeral costs are handled

- A cash inheritance is passed on

Mike’s children don’t start life begging.

They start life protected.

The Truth

You don’t build wealth only to enjoy it.

You build it so it survives you.

Whole Life Insurance is how responsible parents speak—even when they’re gone.

If you’re serious about protecting your children and setting up inheritance,

I’ll help you secure the right cover—properly structured.

Alex Mwangi

WhatsApp: 0703472299