The Debt Dilemma

Debt can either build you or bury you.

The problem? Too many of us are borrowing to survive instead of borrowing to grow.

Are we trapped in bad debt because of lack of income, ignorance, or indiscipline?

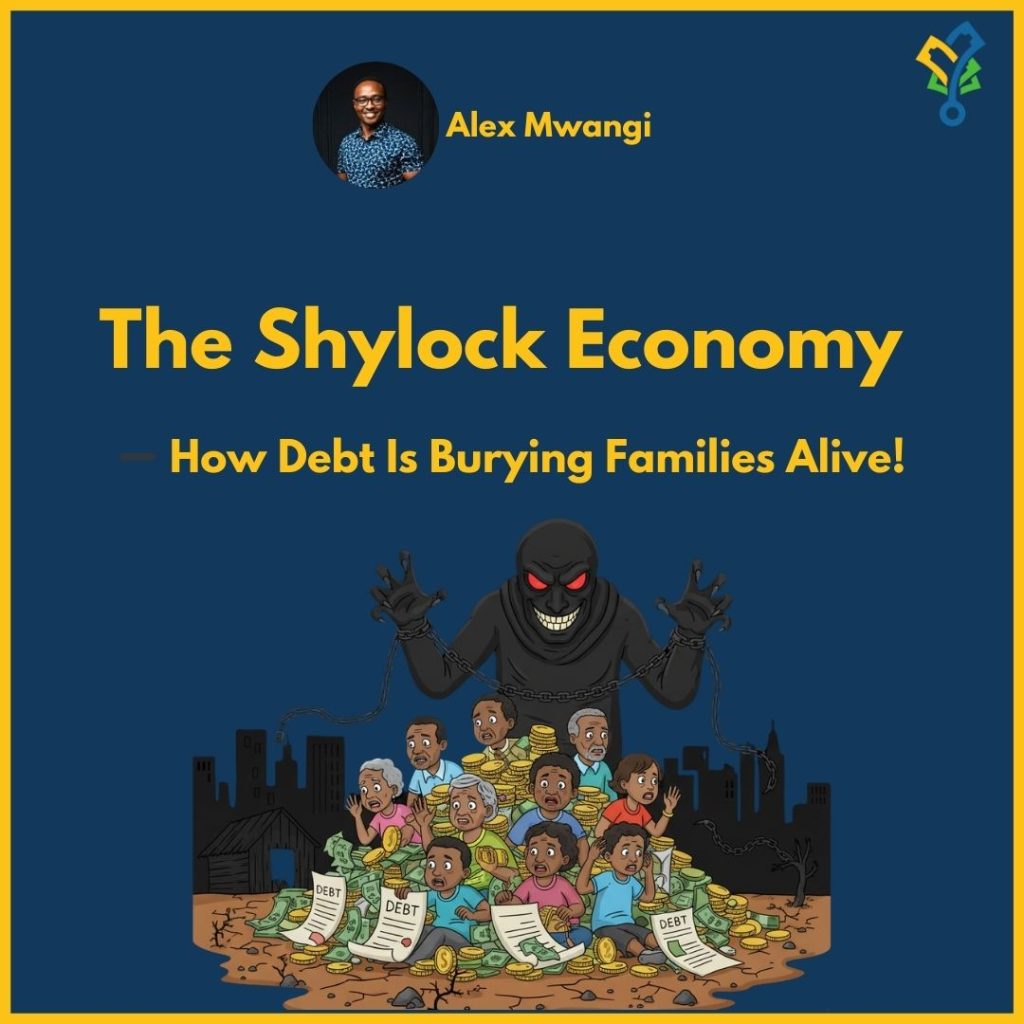

The headlines don’t lie — we are drowning in a Shylock economy.

- Backstreet loans

- Digital loan apps

- Predatory lenders

They promise quick cash but deliver lifelong slavery.

“Quick loans may feel like oxygen today, but they often turn into chains tomorrow.”

Here’s the reality:

People are skipping meals, sinking into depression, and even losing their lives — just to keep up with debts that never end.

Non-performing loans in Kenya now stand at nearly Ksh 697 billion.

That’s not just a statistic — that’s households in crisis.

Why People Fall Into Bad Debt

- Living above their means — chasing lifestyles their wallets can’t sustain.

- No financial plan — money comes in, money flows out, nothing left.

- Borrowing for consumption — paying school fees, rent, holidays, cars, clothing, or weddings with loans instead of building a plan.

- Ignorance — thinking all loans are the same, when in reality, some destroy and some build.

“Bad debt doesn’t just steal your money — it steals your peace, your health, and your future.”

The Truth About Debt

Not all debt is created equal. Some build, others destroy.

Good Debt

- Builds your wealth.

- Funds income-generating assets — real estate, business capital, or investments that bring in cash.

Bad Debt

- Kills your future.

- Funds liabilities — things that lose value or don’t pay you back, like lifestyle loans, consumption loans, and shylock money.

When you take bad debt, you are mortgaging your peace of mind.

When you take good debt, you are leveraging to multiply your future.

“Before you borrow, ask yourself: Is this debt building me or burying me?”

The Way Out

The solution is simple, though not easy:

- Live within your means.

- Build an emergency fund (3–6 months of expenses).

- Plan your money with a budget every month.

- Only borrow to build — not to survive.

Remember, hope is not a financial strategy.

Without a plan, debt becomes your master.

With a plan, money becomes your servant.

“Kenya doesn’t need more shylocks. It needs more financially disciplined warriors.”

Final Reflection

Do we really understand the difference between good debt and bad debt — or are we blindly marching into a personal debt crisis?

Don’t Miss These Opportunities Before You Go!

- Join Cent Warrior Education & Protection WhatsApp Tribe: https://shorturl.at/dzvHz

- Join the Cent Warrior WhatsApp Money & Wealth Mastery Tribe: https://shorturl.at/l7Fgg

- Get Your Free Wealth Masterplan E-Book: https://shorturl.at/n7u0M

- Visit My Resources Hub Here: https://linktr.ee/centwarrior

- Visit My Online Shop Here: https://centwarrior.com/shop/