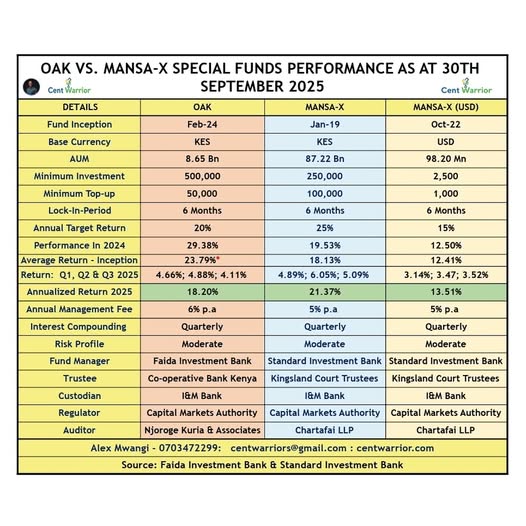

“Alex, should I invest in Mansa-X or Oak Fund?”

That’s one of the most common questions I get. Today, let’s break it down and help you make an informed decision.

What Exactly Are Special Funds?

Let’s start from the familiar and move to the unfamiliar.

Most people begin their investment journey with Money Market Funds (MMFs). These are conservative vehicles that invest in short-term, low-risk assets such as:

- Treasury Bills

- Commercial Papers

- Bank and Call Deposits

Typically, these instruments are limited to local markets and have maturities of up to 18 months.

The problem? When the local economy slows down, your returns drop as well. Currently, you can expect an average of 8% net return from most Money Market Funds.

Enter Special Funds – The Next Level

Special Funds are multi-asset investment vehicles that can invest in:

- Local and international markets

- Both short-term and long-term instruments

- Non-traditional assets like gold, commodities, forex, index funds, and equities

They are structured for both growth and capital protection, using sophisticated models like long/short strategies and advanced risk management systems to optimize returns while minimizing volatility.

That’s why Special Funds have become a preferred choice for both individuals and institutions seeking higher returns with calculated risk.

Comparing the Two Top Contenders

Mansa-X Special Fund

- 2024 Return (KES Fund): 19.53%

- 2025 Annualized Return (KES Fund): 21.37%

- 2024 Return (USD Fund): 12.50%

- 2025 Annualized Return (USD Fund): 13.51%

- Q1 → Q2 → Q3 (2025 KES Fund): 4.89% → 6.05% → 5.09%

- Q1 → Q2 → Q3 (2025 USD Fund): 3.14% → 3.47% → 3.52%

Oak Special Fund

- 2024 Return: 29.38%

- 2025 Annualized Return (KES Fund): 18.20%

- Q1 → Q2 → Q3 (2025 KES Fund): 4.66% → 4.88% → 4.11% (18.20% Annualized)

Key Takeaway

Both funds continue to dominate the market with impressive, consistent performance.

However, Mansa-X has the advantage of experience, with over Ksh 87.22 billion in Assets Under Management (AUM).

On the other hand, Oak Fund is growing rapidly — already managing Ksh 8.65 billion in assets in less than two years of operation.

Both funds are managed by reputable firms with solid track records, making either a sound option depending on your goals and risk profile.

You can choose one — but diversification across both can give you better balance and compounded growth over time.

Diversification Matters

That said, avoid putting all your money in Special Funds. They share similar market exposure and risks.

Instead, diversify further into other instruments such as:

- Fixed Income Funds like Arvocap Almasi Fund

- Equity Funds

- Other growth-oriented or defensive assets

The goal is to build a well-rounded portfolio that reflects your financial goals, risk appetite, and investment horizon.

Alex Mwangi | WhatsApp 0703472299

Below is a side-by-side comparison of both Mansa-X and Oak Special Funds